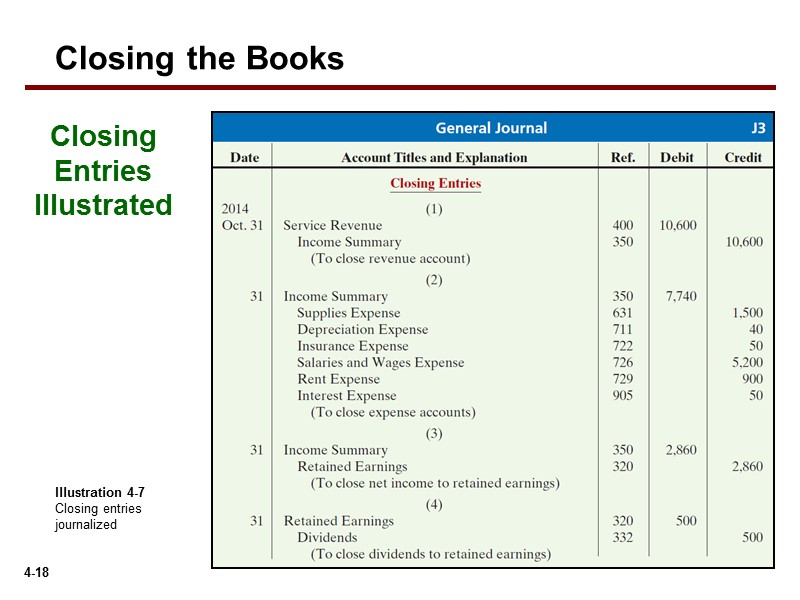

At the end of the accounting period, the balance is transferred to the retained earnings account, and the account is closed with a zero balance. For each temporary account there will be a closing journal entry. Temporary (nominal) accounts are accounts that are closed at the end of each accounting period, and include income statement, client heartbeat with xero dividends, and income summary accounts. These accounts are temporary because they keep their balances during the current accounting period and are set back to zero when the period ends. Revenue and expense accounts are closed to Income Summary, and Income Summary and Dividends are closed to the permanent account, Retained Earnings.

How, when and why do you prepare closing entries?

- These entries transfer balances from temporary accounts—such as revenues, expenses, and dividends—into permanent accounts like retained earnings.

- That’s exactly what we will be answering in this guide – along with the basics of properly creating closing entries for your small business accounting.

- From the Deskera “Financial Year Closing” tab, you can easily choose the duration of your accounting closing period and the type of permanent account you’ll be closing your books to.

- In this guide, we delve into what closing entries are, including examples, the process of journalizing and posting them, and their significance in financial management.

For example, closing an income summary involves transferring its balance to retained earnings. This crucial step ensures that financial records are accurate and up-to-date for the next period, making it easier to track the company’s performance over time. Now that the journal entries are prepared and posted, you are almost ready to start next year. Remember, modern computerized accounting systems go through this process in preparing financial statements, but the system does not actually create or post journal entries. A net loss would decrease owner’s capital, so we would do the opposite in this journal entry by debiting the capital account and crediting Income Summary.

Step #2: Close Expense Accounts

The second entry closes expense accounts to the Income Summary account. The third entry closes the Income Summary account to Retained Earnings. The fourth entry closes the Dividends account to Retained Earnings. The information needed to prepare closing entries comes from the adjusted trial balance. You might be asking yourself, “is the Income Summary account even necessary?

Create a Free Account and Ask Any Financial Question

If both summarize your income in the same period, then they must be equal. Notice how only the balance in retained earnings has changed and it now matches what was reported as ending retained earnings in the statement of retained earnings and the balance sheet. These accounts are be zeroed and their balance should be transferred to permanent accounts. The income statementsummarizes your income, as does income summary. If both summarizeyour income in the same period, then they must be equal.

All revenue and expense accounts must end with a zero balance because they’re reported in defined periods. A hundred dollars in revenue this year doesn’t count as $100 in revenue for next year even if the company retained the funds for use in the next 12 months. Closing entries transfer the balances from the temporary accounts to a permanent or real account at the end of the accounting year. After the closing journal entry, the balance on the drawings account is zero, and the capital account has been reduced by 1,300.

How much are you saving for retirement each month?

We see from the adjusted trial balance that our revenue account has a credit balance. To make the balance zero, debit the revenue account and credit the Income Summary account. In this example we will close Paul’s Guitar Shop, Inc.’s temporary accounts using the income summary account method from his financial statements in the previous example. Both closing entries are acceptable and both result in the same outcome. All temporary accounts eventually get closed to retained earnings and are presented on the balance sheet.

Income summary effectively collects NI for the period and distributes the amount to be retained into retained earnings. Balances from temporary accounts are shifted to the income summary account first to leave an audit trail for accountants to follow. Income summary is a holding account used to aggregate all income accounts except for dividend expenses. It’s not reported on any financial statements because it’s only used during the closing process and the account balance is zero at the end of the closing process. Temporary accounts are used to record accounting activity during a specific period.

This means that thecurrent balance of these accounts is zero, because they were closedon December 31, 2018, to complete the annual accounting period. Our discussion here begins with journalizing and posting theclosing entries (Figure5.2). These posted entries will then translate into apost-closing trial balance, which is a trialbalance that is prepared after all of the closing entries have beenrecorded. Let’s investigate an example of how closing journal entries impact a trial balance. Imagine you own a bakery business, and you’re starting a new financial year on March 1st.

The third entry requires Income Summary to close to the Retained Earnings account. To get a zero balance in the Income Summary account, there are guidelines to consider. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

Leave A Comment